It never goes away, and it probably never will. The independence of Texas–

secession if you will–was the means whereby Texas migrated from one Empire to what

would arguably become another. And if matters had gone differently in the 1860s, Texas

might have been part of and not simply, a whole ‘nother country. Talk of Texit comes

naturally to folks here. You can’t really blame them.

Alas, as the party poopers in economics are accustomed to saying, there is no

free lunch. If we secede, it will cost us something. According to Taxes of Texas: A Field

Guide (Texas Comptroller of Public Accounts, 2024), Federal dollars contributed 37

percent of total state net revenue in 2023 (p.5, if you’re checking). I would understand

that to be net of taxes paid to Uncle Sam, so there is an issue here. If you want out of

The Land of the Free and The Home of The Brave, you have a rather large hole in the

finances of independent Texas. That’s a fact. If you are historically minded, you may

well recall that this was a problem for the Lone Star Republic the first time around, so

here we go again.

It would take a great deal of fancy statistical modelling plus even fancier

assumptions to think the matter would just rest with a busted budget. That’s because it

can’t. Economists also use a term “structural adjustment” to pretty up the belt-tightening

that must accompany such a problem. It would be a matter of speculation here to say

exactly how much tightening it would take, but previous experience in the 1980s in our

buen vecino, Mexico, can give us some sense of how things would work. The situation

is not wholly novel.

Lots of things would have to happen for an independent Texas to make a go of it.

The first is that Austin would probably have to go out on the international market and

borrow–and remember, a lot of those money center banks will remain in the United

States in places like, excuse me, New York. Don’t expect much sympathy for reasons

most of us already know. Even if we could borrow a fast 70 billion, it comes with strings

and interest rates. How much and what? Who knows? But never fear, whatever

currency Texas is going to issue will probably depreciate (fall in value) quickly, if history

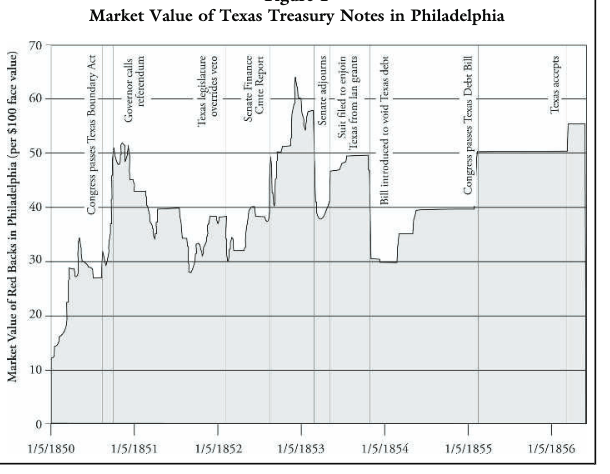

(that Lone Star thing again) is any guide. Don’t take my word for it. The economists Gary Pecquet and Clifford Thies have published a series of papers on Texas Treasury bills and the Texas debt in The Independent Review. They make it pretty clear that, for the most part, Texas debt obligations (money, bills, etcetera) were not worth the paper they were printed on. (This is their graph, as low as 10 cents or so on a dollar in 1850)

Of course, a worthless currency is cheaply purchased, so, our exports are going to become more competitive. That’s good, because a lot of what we currently consume is what is going to have to be exported to raise the money to pat debt service. Again, ask one of our

friends in Mexico how that works. You turn your domestically consumed goods into exports by making them cheap enough to be sold overseas. This is no fun because the domestic standard of living has to fall–you consume less, silly patriot. How drastically? In Latin America, the 1980s were called The Lost Decade. Mexico, to be blunt, has never really gotten its mojo back. You lose a generation of consumption here and there, and pretty soon, you end up poor. This same movie is showing in now playing in Argentina, in case you doubt me.

Just scare tactics? Are you feeling lucky? A fiscal implosion is, sorry to say, no

fun. Freedom is not free, even if talk, especially big talk, is cheap. And in Texas, talk is cheap.

great antidote to insufferable and never ending Texas chauvinism.

LikeLike